Bitcoin’s Consolidation Continues amid Addresses Holding BTC Scaling the Heights

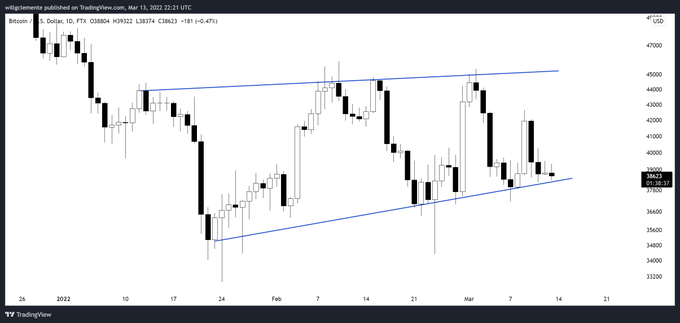

Bitcoin has consolidated between the $38K and $45K zone for the past two months, as indecisiveness continuously rocks the market.

On-chain analyst Will Clemente acknowledged:

“BTC has been in this consolidation pattern for 2 months.”

Source: TradingView

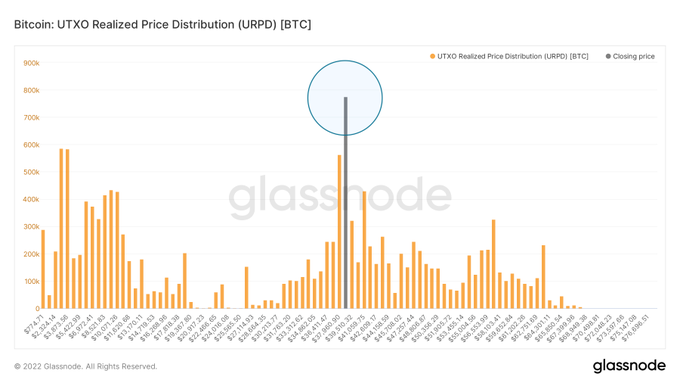

Market analyst Lex Moskovski shared similar sentiments, describing the current BTC market as “the mother of all consolidations.” He noted:

“The mother of all consolidations. On-chain volume at $39k is the largest in the entire history of Bitcoin. Record 775k BTC changed hands at around $38.7.”

Source: Glassnode

Moskovski added that Bitcoin had moved around $39,000 more than any other price in its 13-year journey based on the high on-chain volume recorded.

The leading cryptocurrency was down by 1.5% in the last 24 hours to hit $38,419 during intraday trading.

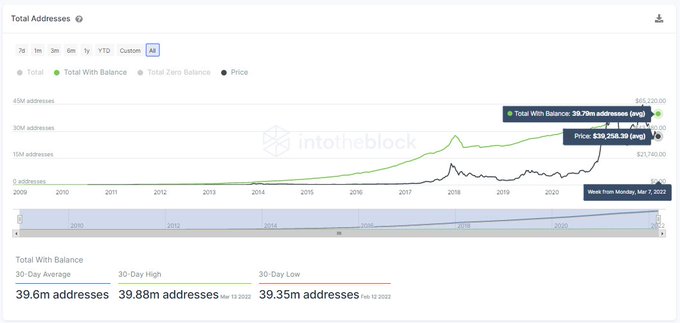

Bitcoin addresses continue soaring the heights

Despite the consolidation happening in the market, BTC addresses continue going through the roof. Data analytic firm IntoTheBlock explained:

“The number of addresses holding BTC continues setting new records. Bitcoin addresses with a balance reached a record of nearly 40 million. Even as BTC has remained on a downwards trend in 2022, the network added a total of 888,000 new addresses with a balance.”

Source: IntoTheBlock

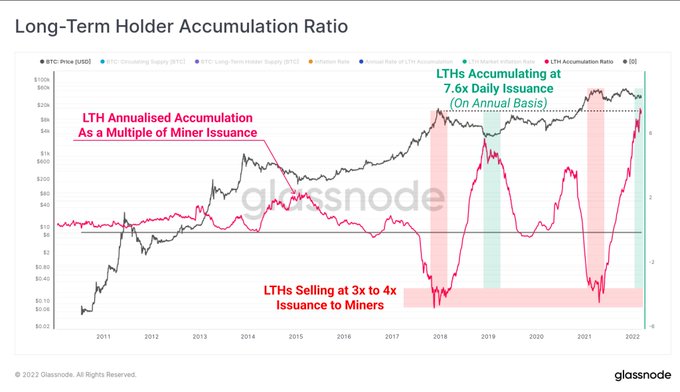

BTC long-term holders have been leading the pack in accumulating more coins. On-chain analyst under the pseudonym Checkmate stated:

“Bitcoin long-term holders are adding to their balance at an annualized rate of 7.6x issuance. With ~900BTC in mined issuance per day, this means around 6,840 BTC is moving into LTH storage daily.”

Source: Glassnode

Meanwhile, large institutional transactions have been dominating Bitcoin volume at 99%. Institutional investments have played an instrumental role in revolutionizing the BTC ecosystem. For instance, they enabled the leading cryptocurrency breach the then all-time high of $20,000 in December 2020 after three years of waiting.

Image source: Shutterstock